Banking Customer Journey

The Banking Customer Journey represents an extract from a comprehensive human-centered research on the Swiss retail banking landscape, conducted in 2016 in cooperation with Asteroidea AG, a strategy and investment firm, to enable a holistic view on the banking customer experience.

Throughout our research we found that customer’s opinions regarding banking are at an all time low. The financial crisis has exacerbated the lack of trust in banks and bankers, while at the same time exerting pressure on banks to cut costs, trim services and automate wherever possible, creating a cyclical effect that is difficult to break away from. With new financial providers entering the market, customers have more options than ever and no longer consider banks to offer critical advantage over newer types of banks or technology corporations. Therefore, we at Spark Labs believe, that this is a crucial time for financial institutions to stay relevant by providing the most superior, consistent and effortless customer experience in order to acquire new, retain existing or win back lost customers. This requires a shift from a transactional mind-set to a more customer-centric approach.

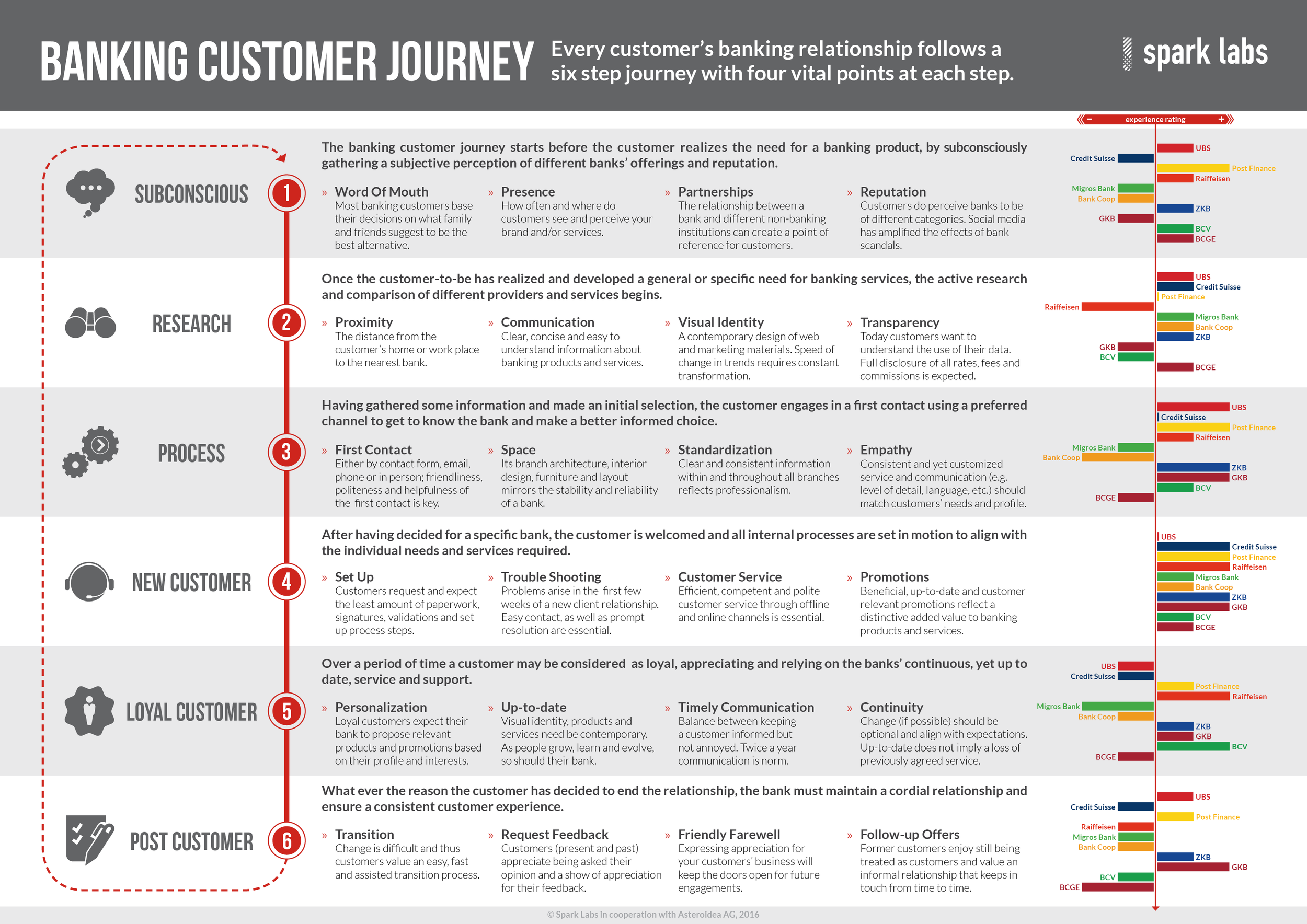

In order to analyze the customer experience of various banks in the Swiss market our team of interdisciplinary researchers conducted over 150 in-depth qualitative customer interviews and 60 branch visits to different banks. Based on this research we were able to identify six main steps, through which customers go in relation to any banking service or product, may it be a mortgage or an investment. Each of these steps represents various touch points between the bank and the customer, may they be physical or digital. Based on our extensive research, we have selected four key touch points for each step of the journey that clearly differentiate a bank from its competitors from the perspective of the customer’s experience.

The journey of any banking customer starts on a subconscious level. Before the need for a banking product arises, the customer unwittingly gathers a subjective perception of the different banking providers. Our research shows, that besides touch points such as word of mouth, presence or partnerships, it is specifically vital at this stage what subjective impression of a bank’s reputation a customer has received. In the case of Credit Suisse for example, many respondents unconsciously associate it with the banking crisis without being able to give substantiated explanations. Raiffeisen on the other hand, as one of the view successful foreign banks in the Swiss market, has managed to position itself as a local, customer-oriented financial institution that is very much valued for its regionality. Particularly appreciated is their strong network of partnerships with local institutions offering culture and leisure activities.

Once the customer-to-be perceives a general or specific need for banking services, he will start to actively research and compare different potential providers and services. Touch points such as proximity, communication, visual identity and transparency are now becoming increasingly important. Post Finance customers for instance seem to face many problems during their initial research phase, when trying to gather information in one of the regular Post offices. The often poorly informed Post staff does not feel responsible for the bank’s offering and just refers interested clients to the Post Finance’s website or hotline. When it comes to consistently applying a modern and appealing visual design throughout different channels and media, UBS proves to be at the forefront of the banking market.

During the process phase that follows next, customers engage in a first contact in order to become familiar with the bank and its practices to make a better informed choice. Despite an increasing number of customers that say they would consider going digital-only for all their banking needs, the majority of customers still value the initial branch experience. This means, that among other factors, the physical space of a bank represents an essential factor to be considered when designing the customer experience. This is shown clearly, when customers visiting a Coop Bank, complain about the space feeling dusty, cold and untrustworthy to an extend that they would avoid having to come back. At the same time touchpoint such as standardization and empathy are equally relevant for the customer’s experience. During the first contact at ZKB, for instance, customers-to-be receive their very own profile summarizing specific needs and potential solutions customized by an advisor instead of standard marketing leaflets like most other banks would offer.

Having chosen a specific bank, the customer will be welcomed, while internal processes are actuated to set up the required offering according to his needs. As customers get more and more used to intuitive and seamless experiences from the likes of Amazon, Google or Apple, they expect their banking applications to be just as simple and sophisticated. Good ratings across all banks show that most providers have realized this and adapted their set-up, trouble shooting, customer service and promotions during this phase accordingly. Clients, like the ones from ZKB, start off their banking relationship on the right foot when they quickly receive benefits targeted to their profile and needs, such as free night rides for students, zoo offers for families or monthly business magazines for business people.

After a certain period of time the customer moves along to the loyal customer phase, when he becomes used to and appreciates the bank’s reliable, up-to-date service and support. At this point customers no longer accept one-size-fits-all solutions, but rather demand banking products that respond to their individual needs, delivering a personalized service based on their history. Our research indicates that small cantonal banks, like the BCV that develops customer-tailored cards, perform better when it comes to anticipating their clients specific needs and offering customized solutions. Sudden changes, such as being charged for paper statements that were free up until this point, can really throw off long-term customers expecting continuityin their previously agreed service and accept change only when optional and aligned with their needs and expectations.

During the last step, whenever a customer has decided to end the relationship, it is the banks responsibility to maintain a cordial relationship and ensure a consistent customer experience. Many banks seem to neglect the importance of these last touch points: a seamless transition, friendly farewell, feedback requests and follow-up offers. Instead, the majority of banks charge their customers closing fees for long and tedious termination processes without realizing, that no matter how well-designed the previous banking service has been, this will be the last and remaining impression customers take away from their banking relationship. Many former GKB customers seem to be so content with how their bank handled the account closure process by requesting honest feedback to improve its service and offering alternative solutions, that they would considerer coming back and recommend it to friends and family.

We believe the future holds various challenges, but also tremendous opportunities, for banks that understand the needs and behaviors of their customers. If banks are dedicated to using these insights to take action, they can truly add value to their customers’ lives. Therefore, optimizing and redesigning their customer experience along the steps of this Banking Customer Journey could represent the first step to becoming a bank of the future.